The Inside Bar Trading Strategy Guide

Contents:

To use the inside bar as a reversal you need to see it formed at swing highs or lows and at key price action levels. If the trend continues, the trader increases his profit, and in case of a reversal, he takes the profit and prepares to enter a reversal. The inside bar is a figure of uncertainty, the participants are not sure about the further movement. The breakout of an extremum means determining the direction, so when the breakout is in the direction of movement, the price accelerates. But the breakout is not always true, there are false breakouts, the price consolidates near the inside bar.

This is one of the most popular technical chart patterns around and there are several trading strategies that utilize this pattern. Before we get into actual trading strategies, let’s see at what an Inside Bar looks like, what it can tell us, and why it happens. The standard InSide bar has a small range and is “covered” by the previous candle.

Beginner’s Guide to Stock Chart Patterns • Benzinga – Benzinga

Beginner’s Guide to Stock Chart Patterns • Benzinga.

Posted: Fri, 30 Sep 2022 07:00:00 GMT [source]

What the inside bar ought to have is a higher low and a lower high than the preceding or mother bar. If on a smaller frame of time, like a 1 hour chart, then a daily chart inside bar for Forex will, from time to time, form a triangular pattern. The inside bar is only at first glance a simple figure to interpret. Well-executed inside bars don’t show up very often on the chart, so don’t look for them where they don’t exist. If there is no confidence, then it is better not to enter the market.

Don’t make this common mistake when trading the Inside Bar…

Previously, you’ve learned how Inside inside bar trading strategy allows you to catch reversals in the market. This is a standard Inside Bar candle where the range of the candle is small, and it’s “covered” by the prior candle.

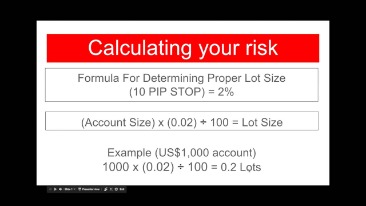

Depending on the close, the bar could represent indecision, trend, or a reversal within the market. Did you know that Admirals offers an enhanced version of Metatrader that boosts trading capabilities? The key to the inside bar reversal strategy is where the inside bar forms. So now we know where to enter the inside bar trade, but to really understand why relative size is important we need to understand where to place our stop loss order. The inside bar can be an extremely effective Forex price action strategy.

Multiple Inside Bars

So, when you see multiple Inside Bars together, it’s a strong sign the market is about to make a big move soon. This is still an Inside Bar as the range of the candles is “covered” by the prior candle. This tells you there are indecision and low volatility in the markets. The nonfarm payroll, or simply the NFP, is always an important and influential event in the economic calendar. In this article, we answer these questions, examine how to trade the NFP, provide an example of an NFP trading…

Here’s how I would’ve https://g-markets.net/ed the inside bar trade we looked at earlier. Inside bars should not be considered if the market is in a range. Traders think this move will continue upwards and pile in only to get slammed.

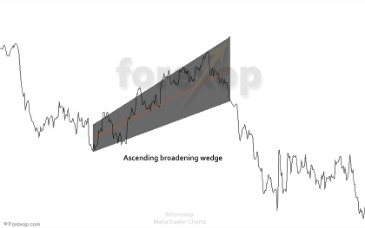

Reversal trading

You can use it to find new trades and you can also use it to manage your trades. Because this is an indecision candlestick it is very important to pay attention to where and how this pattern forms. This can be very important information when used correctly, however it is important you note where the inside bar forms and in what type of market. There is often confusion around the wicks or shadows of the candlesticks.

Though this might seem a bit confusing at first, it is quite simple once you take a bit of time to understand it. The signal begins to show up when you have an inside bar and that can be easily scanned for. In this stock chart example, assume the ATR reading of 14 periods is .38 when we use a multiplier of 1 ATR.

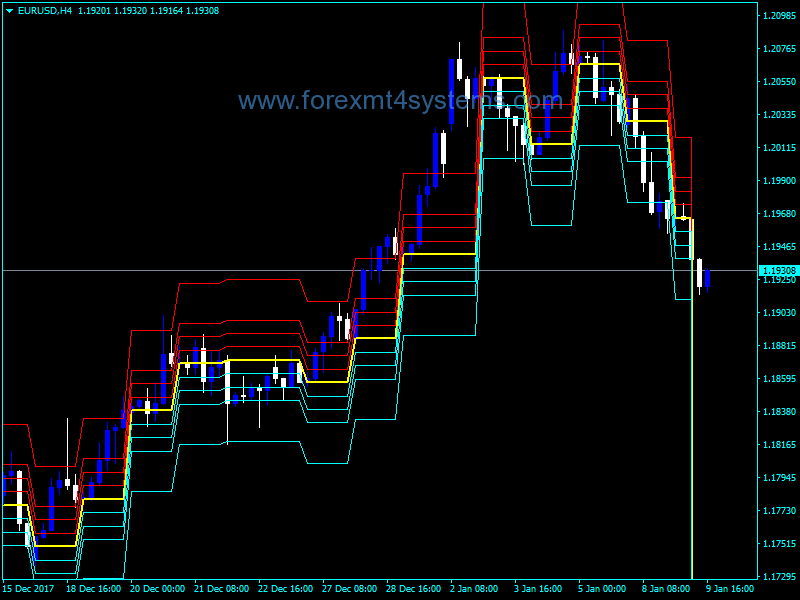

It will draw real-time zones that show you where the price is likely to test in the future. Stop loss level will always be placed on the other side of inside bar. Like if order opens at the high of inside bar, then stop loss will be below of low of IB. From there, if you’re happy with the results, you can make the decision to start trading the strategy live. Of course, a trend can be difficult to identify, so be sure that you have a concise definition of what a trend looks like for you. So here are a few times when you should avoid taking an entry.

There are 2 basic types of Inside Bars that traders use to enter trades. We see this on longer timeframes when price forms a “box,” or a tight range. This is my preferred approach as you’ll enter the trade as the price moves in your favour — but there’s a possibility of a false breakout. This bar is still “covered” by the previous candle, but the range is larger than the standard.

We caution traders here because with low probability trades like this example, the market does not have a smooth range and it could prove more trouble than it is worth. Depending on what you are trading and what your end goals are, your exits will vary. If you are looking to capture a swing, some traders find it most helpful to exit trades before any opposition starts. If aiming to ride a trend, however, traders tend to trail their stop loss just as the market begins to adjust to their prediction.

Master the Simple Inside Bar Breakout Trading Strategy

Continuation signals often result in a continuation of the preceding momentum, prior to their formation. Inside bars like that, most of the time result in nice breakouts in-line with the current trend, as well as near-term momentum. We mark the inside candle’s high and low as in the previous two examples . A conservative trader would identify the ID NR4 breakout when the price action closes a candle below the bottom of the pattern. An aggressive trader would identify the ID NR4 breakout when the price reaches a few pips below the bottom of the pattern.

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

The trader always knows exactly where to place a reasonable stop and limits losses in case of an erroneous entry. During the initial decline, the price action creates an inside bar candle formation on the chart. Thus we can mark the high and the low level of the inside range. The next candle which comes after the inside bar breaks the upper level of the range. As you see, the price begins to reverse afterwards, and within the next two bars, the price decrease leads to a break of the lower level of the range. This confirms the Hikkake pattern on the chart, and with that, we should get ready to initiate a trade to the short side.

Inside Bar Trading Strategy

As mentioned earlier, InSide Bars can vary in terms of size, and can also vary in range, color, etc. Here are a few types of bars that you will most likely use when utilizing the InSide Bar Strategy. The inside bar is formed because price was not able to break either the high or the low of the previous session. This shows us that neither the bulls or the bears were in control during the session.

One reason the inside bar trading strategy is a popular technical analysis technique is it is one of the best ways to indicate a potential breakout and momentum move in the market. When price breaks those key levels, it tends to move to the next key level. The Fibonacci tool is a powerful natural tool and I have used it to adjust take profit level.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

For more information on trading inside bars and other price action patterns, click here. This pattern tells the trader where there is low volatility within the markets. As market volatility is always shifting, it helps to see multiple InSide Bars together because it is a strong sign that there will be big movement in the markets. Traders use the InSide Bars strategy by waiting for price to make a reversal move and then form an InSide Bar.

The InSide Bars are not all equal in terms of size and range, and it is important to keep this in mind throughout your analysis. This will be explained further below in our What to look for section. There are technically two ways of trading an inside bar setup, and that is as either a reversal or a continuation signal.